Blind Spots in Resident Screening

Nov 15, 2023

The basics of resident screening

Most resident screening companies aggregate and evaluate three main data sets: (i) FICO scores, (ii) criminal background checks, and (iii) eviction court records. Some of those services offer income verification as well.

So what's wrong with FICO scores and eviction court records? The answer: a lot. Those data sets work (experts recommend you keep using them), but they have major blind spots.

Did you know…

Credit bureaus & FICO: The "big three" bureaus do not have renter data at scale. Less than 5% of landlords report rent payments of any kind to the big three credit bureaus. They allow landlords to conduct metro 2 reporting of payments but very few do, unlike credit card companies, utility companies, and banks. If you want to know about an applicant's rent performance, credit bureau reports are the wrong place to look!

Eviction Records: Less than 20% of landlord-tenant disputes get resolved in court. Most landlords do not proceed to a formal eviction. The vast majority of the time, they approach the resident and say, "Hey Aaron - you've stopped paying your rent. Why don't you pay me half of your outstanding balance and move out by the 1st of next month. Then we can shake on it and call it a day." Eviction records have no visibility into the financial and contractual realities of this landlord-tenant interaction.

Reporting Lags: Most eviction records are uploaded to the county court records manually by an administrative clerk. The documentation is not real time. The county clerk may or may not upload the documentation in a timely matter. Often there can be a 1 to 12 week lag. By that time, the resident has already been approved and moved into your community without the knowledge of a critical data and rent performance history.

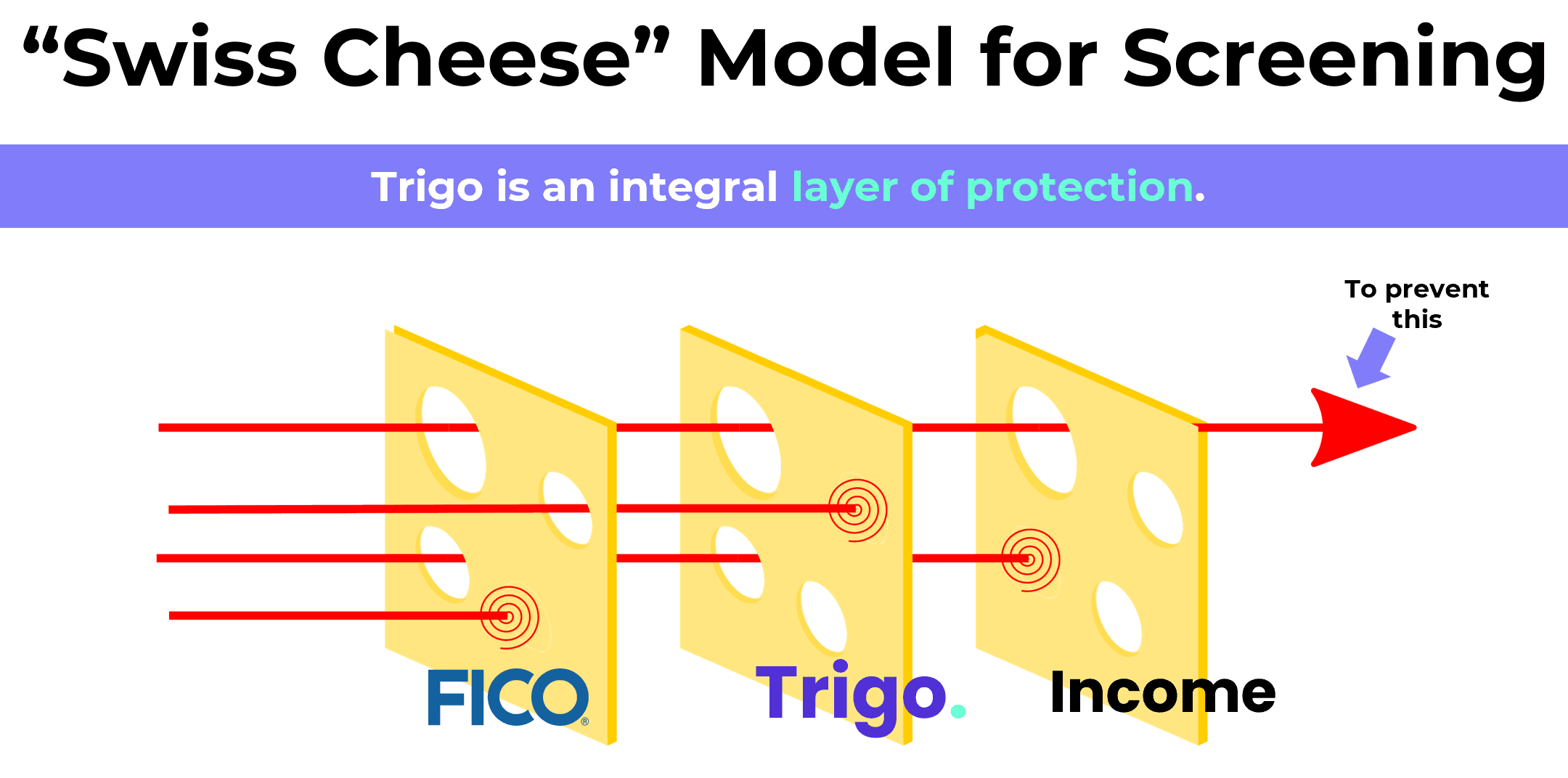

The "Swiss Cheese" model

When it comes to underwriting or screening data sets, there's no "silver bullet" or single data set you can look at. Better screening is about the combination of multiple data sets to paint a more fulsome picture of the applicant's likelihood for payment. We call this the "Swiss Cheese" model for resident screening.

Added layers of protection

We don't want you to fly blind. But no need to fear, we have a list of helpful solutions that help aid that help fix these gaps in basic screening data.

Document fraud is a big issue on the rise with applicants altering pay stubs or bank statements. Snappt is a great solution for detection fraudulent documents.

Identification fraud is also another big issue. MRI's Checkpoint ID solution offers advanced facial recognition and can scan ID's against global identity databases.

If you have a lot of applicants with non-W2 income, Payscore is a great solution for verifying income without pay stubs or consistent income.

Conclusion

There are numerous valuable screening products on the market for you to choose from, but very few address the most significant blind spots of rent verification—often the most important piece of the screening puzzle.

With market-leading completion rates (>75%) and the industry's fastest turnaround times, Trigo provides real-time rent verification that gets entirely missed by credit bureaus and other screening and data providers.